Will US winter retail demand expectations support lower propane inventory levels? – Week 44 2024

How US Winter Retail Demand Can Affect Stock Levels

One of the key unpredictable factors in the U.S. supply/demand balance is the residential/commercial propane consumption, as it heavily depends on weather patterns and seasonality.

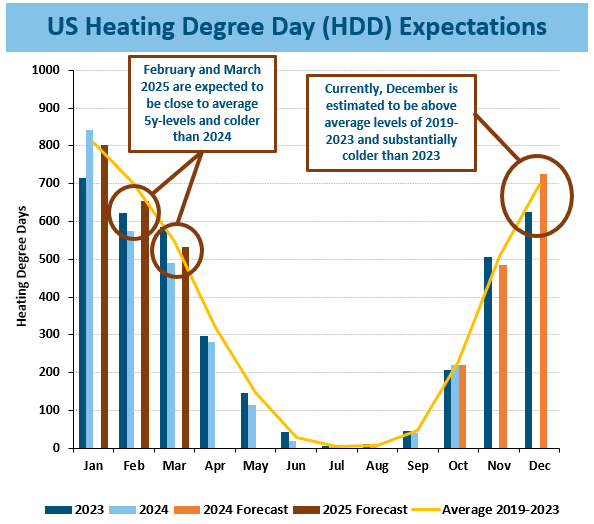

Long-term weather accuracy remains “questionable,” but in the absence of a better way to predict demand, we rely on Heating Degree Days (HDDs), a measure used to estimate the energy required to heat buildings.

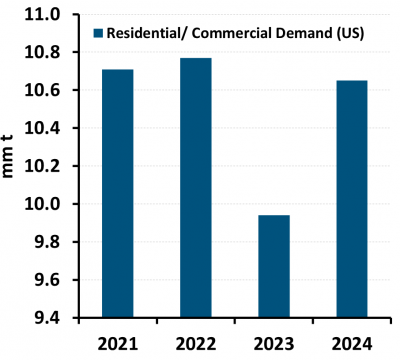

- 2023 was one of the mildest winters in recent memory, leading to a decrease in residential propane demand by about 0.7-0.8 million tons year-over-year. In contrast, 2024, while not exceptionally cold overall, experienced a significantly cold January and is expected to have an above-average cold December, both of which create substantial demand in the residential sector.

- The overall increase in residential demand between 2023 and 2024 is estimated at 0.6-0.7 million tons, effectively bringing it back to pre-2023 levels. Additionally, forecasts indicate that Q1 2025 could be colder than the same period in 2024, which is likely to sustain residential demand at elevated levels.

- The U.S. propane market is currently experiencing an oversupply, with historically high stock levels.

- This situation stems from increased production, stagnant domestic demand, and limited export capacity—a trend expected to persist into the first half of 2025.

- NGLS projects an inventory draw of approximately 2.6 million tons for Q4 2024 and Q1 2025, compared to a 4-million-ton draw during the same period last year.

- The difference in residential demand for this timeframe is estimated at around 0.2 million tons.

- Even if the winter is colder than anticipated, unless a severe “polar freeze” occurs, the increase in residential demand is unlikely to exceed 0.5–0.7 million tons. Consequently, NGLS expects inventory levels to remain historically elevated, exerting downward pressure on propane prices.