LPG production from Saudi Arabia to rise in 2025 – Week 39 2024

Additional Non-Associated Gas Production Also Expected

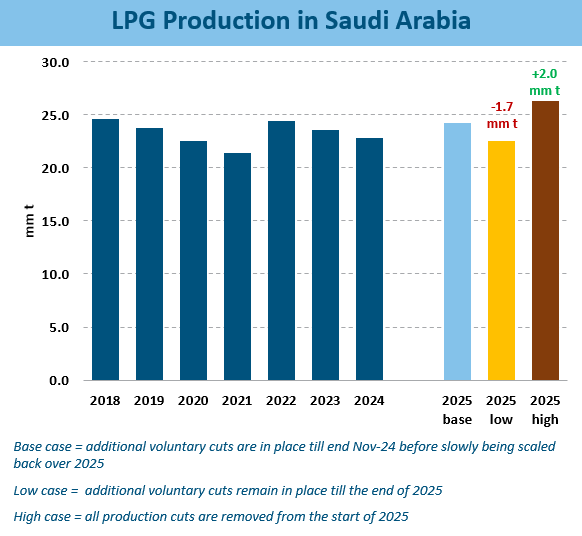

Some headlines last week mentioned Saudi Arabia could be looking at raising crude oil production over the next 6 months, dropping the $100 crude oil price target, looking at higher market share. Currently additional voluntary production cuts are in place until the end of Nov 2024, after which time, these are expected to ease. NGLStrategy already expected higher production in 2025, but what would varying scenarios mean for LPG?

- Currently, NGLStrategy expects crude oil production to follow the announcements by OPEC+ to maintain the additional voluntary cuts in Saudi Arabia until the end of Nov-24 before they are slowly scaled back throughout 2025, whilst the production cut announced in April 2023 is maintained.

- With additional LPG production in Saudi Arabia also expected to come from non-associated gas production with the ramp up of the Hawiyah/Haradh project and the start of gas from Jafurah development in 2025.

- Overall, NGLStrategy expects LPG production to rise by around 1.5 mm t in 2025 from 2024 but will be highly sensitive to political decisions and overall global oil/gas dynamics.

Different Scenarios

- However, should different crude oil scenarios come into play, what will this mean for LPG?

- On the graph on the right, we look at a low case and a high case scenario with regards to crude oil production levels.

- In the low case scenario where the voluntary cuts are extended for the whole of 2025, we could see a drop of around 1.7 mm t in LPG availability. In the high case scenario (potentially more aligned to the headlines seen last week) would see a further 2 mm t of LPG production in Saudi Arabia.

- Of course, not all this volume may be sent to the export market, with a significant petrochemical industry for LPG within the country.