Propane prices are affected by weather, but other factors could curb the impact – Week 01 2025

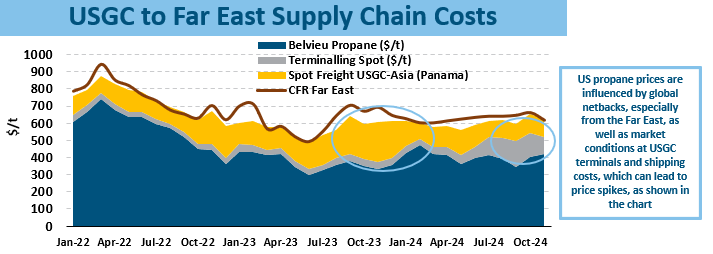

A cold spell in the US has driven Mont Belvieu prices higher for January, pushing propane supply chain economics to marginal levels and compressing terminal and shipping costs. The key question is how much further the cold weather will impact propane prices and the supply chain.

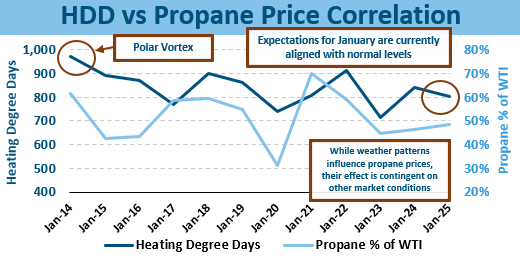

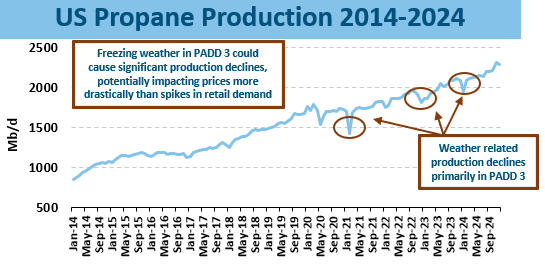

Based on HDD data, January is colder than recent mild winters, although still below average compared to historical norms. One crucial factor in the analysis is US propane production, particularly from the Permian. If weather conditions are harsh in West Texas, a sharp decline in production could lead to significant inventory draws to replace the “lost” volumes and meet higher retail demand.

Currently, international markets aren’t providing a higher delivery price ceiling, so Mont Belvieu prices are expected to stabilize between 80-90 c/g in January, reflecting the cold weather’s impact. However, terminal fees and shipping costs will remain relatively squeezed, to allow open arbitrage opportunities.

If January and possibly February turn out colder than expected, Mont Belvieu prices could spike, leading to substantial inventory draws. At the same time, international demand may decrease, as PDH importers may struggle to justify high delivered prices. Terminal and shipping costs might not have substantial potential to decrease, which in turn could lead to further arb pressure. Other international importers, such as steam-cracking or retail-related buyers, may also be squeezed out, but likely only for a short period.