Impact of tariffs on the Polish LPG market – Week 04 2025

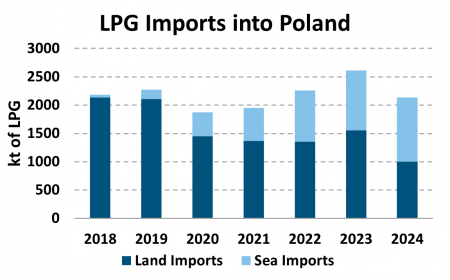

At the end of December 2024, additional tariffs came into play in Poland with regards to receiving LPG volume from Russia. According to POGP, in 2023, land imports reached over 1.5 mm t coming from not only Russia but other sources. It is estimated that this volume will have declined in 2024 with a further fall predicted in 2025.

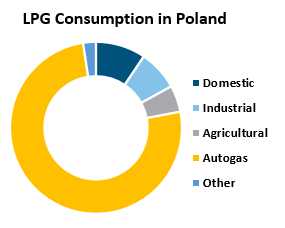

- Demand in 2023 was around 2.4 mm t but NGLS expects this to have fallen in 2024 with the majority being for Autogas.Not all of this demand can be met through the current seaborne import terminal infrastructure however, and despite some domestic production, land imports are still needed if the demand is to continue at the current levels.

- With the additional sanctions coming into play (albeit not all LPG grades), NGLStrategy still expects some reduction in the overall level of retail demand over the next couple of years.

- Since the start of the conflict, the rise in seaborne trade has seen a rise from around an average of 50,000 tons per month of LPG to nearly 90,000 tons a month in 2023 and 2024 according to NGLStrategy’s ship tracking analysis.

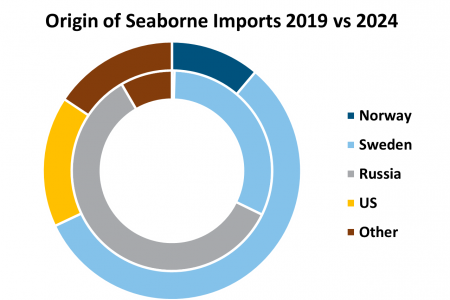

- The origin of LPG has also changed. In 2019, nearly all of the volume imported via seaports was from Russia or Sweden. In 2024, analysis of ship tracking shows a significant increase in volume originating from the US being imported into Poland, and an obvious reduction in seaborne LPG from Russian ports. Higher volume from Norway and Sweden was also observed in 2024, with re-exports playing a key role.

- NGLStrategy expects this trend to continue with the average volume remaining around 100,000 tons per month with increased volume from other sources rather than Russia e.g. the US.