Unrest in the Middle East sparks market uncertainty – Week 24 2025

Lower Supply to China Could be Seen

Although the ultimate impact of recent developments in the Middle East remains uncertain, NGLStrategy evaluates the potential ramifications for the LPG market should tensions persist or escalate. Several scenarios could unfold, including a complete loss of Iranian supply, elevated crude oil prices, and disruptions to shipping routes and market flows. These scenarios do not yet factor in the potential for broader escalation involving other regional or global actors.

Loss of Iranian Supply

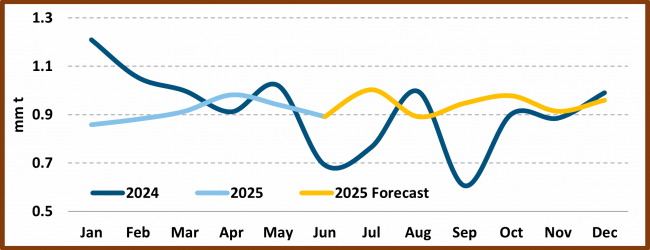

- As shown in the adjacent chart, Iran has been exporting between 0.9 and 1.0 million tons of LPG per month, a level expected to be maintained through the remainder of 2025. This represents roughly 8% of total global monthly LPG exports.

- The bulk of these volumes are shipped to China at significant discounts, enabling Chinese buyers to secure favorable economics even when regional spot prices in the Far East suggest otherwise. Should Iranian exports be curtailed due to escalating tensions, Chinese importers could face higher import costs. This may tighten the East of Suez market further, particularly given the 10% tariff burden on U.S.-sourced volumes. In a more constrained scenario, Chinese petrochemical producers could be compelled to reduce operating rates if alternative supply proves uneconomical.

Higher Crude Oil Prices

- As already observed, crude oil prices have responded to the recent unrest, rising from $69/bbl at the start of Week 23 to $76/bbl at the end of the week. If sustained, this price environment could economically incentivize increased production in other regions—particularly in the U.S.—where additional associated gas output may generate notable incremental LPG volumes.

- However, global crude demand remains constrained, with several reports indicating limited upside for further price increases. Nevertheless, any supply disruptions in the Middle East could trigger compensatory production elsewhere without materially raising overall global supply levels.

Impact on Shipping

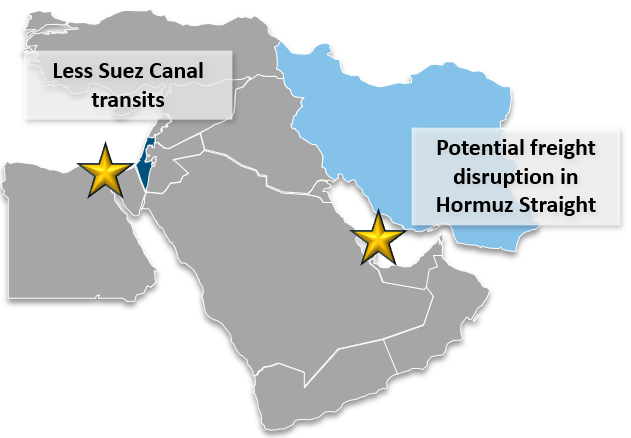

- A potential disruption of trade through the Strait of Hormuz could significantly impact global oil, gas, and LPG seaborne flows, prompting the need for replacement volumes from alternative sources. This would substantially increase ton-mile demand in the VLGC market, likely triggering sharp spikes in freight rates.

- Additionally, rerouting of cargoes away from the Suez Canal—toward the Panama Canal or the Cape of Good Hope—would further tighten vessel availability and support stronger shipping fundamentals.

- Concurrently, elevated crude oil prices would drive up bunker fuel costs, compounding the upward pressure on freight rates.

Iranian LPG Exports