Loss of LPG demand in petrochemicals – Week 32 2025

The economics of producing ethylene via steam cracking have been challenging for many petrochemical producers in recent years, a trend expected to persist amid continued overcapacity in both ethylene and propylene.

In response, several companies have sought to curb losses by closing capacity or shifting feedstocks.

NGLStrategy examines the implications of these moves for LPG use among major petrochemical players

NW Europe

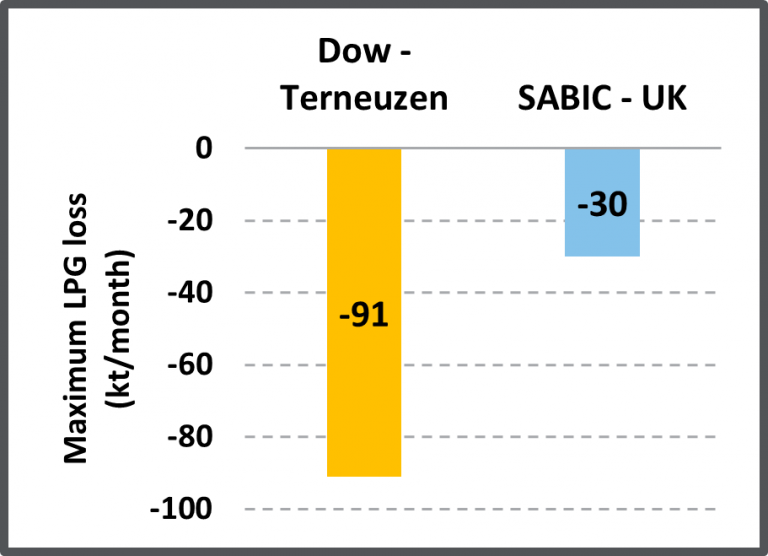

- A number of steam crackers have announced closures in Europe, with the most recent being Dow’s Böhlen plant in Germany. Although the majority of these closures don’t impact LPG import demand directly, as they are typically naphtha fed, there is one plant which is likely to lower overall imports into NW Europe in the 2nd half of 2025: Dow’s cracker at Terneuzen.

- It was announced earlier this year that they will idle some of the capacity at this site, taking off around 680 kt of ethylene capacity. NGLStrategy assesses this to be a loss of around 90,000 tons of LPG per month (if all of the capacity was utilised for LPG). It is unclear if the idled capacity will come back online, being subject to improving market conditions.

- Another plant to mention in NW Europe is the decision to not restart the SABIC cracker in the UK. Although the plant was due to restart running on ethane only, in the past it has imported around 40,000 tons per month before closing in 2020 for a long period of maintenance.

Asia

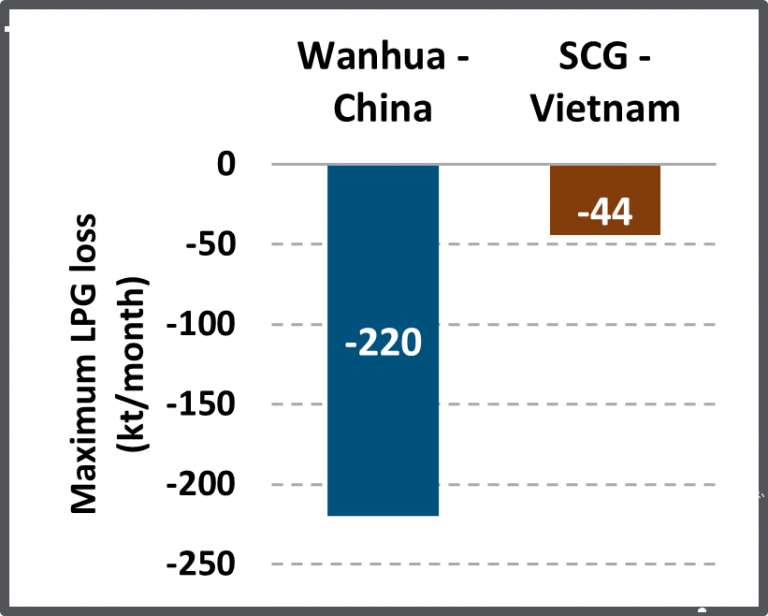

- Perhaps the biggest impact on the LPG market over the next few months, is the conversion of Wanhua’s Yantai facility from utilising propane to ethane as a feedstock. The 1 mm t ethylene capacity plant began operating in 2020 utilising propane primarily as a feedstock with an estimated maximum LPG demand of around 220,000 tons per month. Typically, from ship tracking analysis, around 200,000 tons is imported per month for utilising at this facility.

- The conversion of this plant from propane to ethane is one of the projects involved in Wanhua’s ethane developments, which includes the recently added ethane/naphtha cracker in Yantai which has a capacity of 1.2 mm t of ethylene and began operating in Q2 2025.

- In Vietnam, a flexible steam cracker started in 2022 but has remained offline for most of 2024 and 2025. Reports now suggest that it may not restart until it converts to fully ethane as a feedstock around 2027, removing around 44,000 tons per month of potential LPG demand.