How US–China Tariffs Reshaped Japan & South Korea’s LPG Supply and Demand – Week 39 2025

With the US-China trade tariffs being a dominant part of the LPG market in 2025, both Japan and S. Korea have been at the forefront as well as countries likely to “swap” US origin LPG cargoes for other non-US volume.

Japan

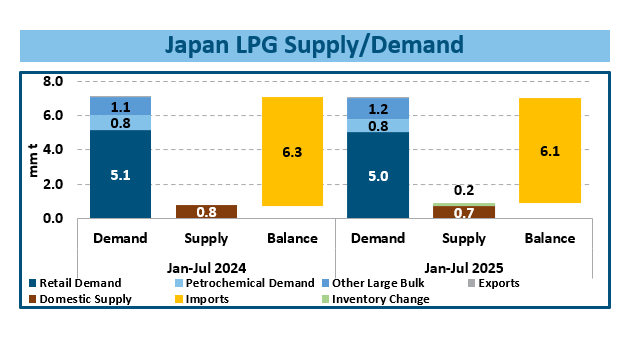

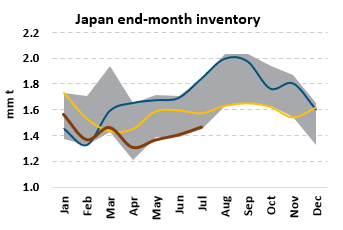

- Importing around 10 mm t per year of LPG, Japan is a key country, despite overall demand not expected to grow as the majority of imports are for retail applications, and with the market maturing, demand is forecast to decline for residential use. However, they do have quite a significant storage level with a minimum requirement of 40 days equivalent of domestic demand.

- 2025 has seen inventory levels remain near the minimal levels from 2019-2024 as stock volume has been utilized to meet the domestic demand, requiring less volume to be imported, as seen on the full supply/demand balance.

- The origin of the imported LPG has significantly changed, with around 1.2 mm t more volume originating from the US in the first eight months of 2025 vs 2024 offset by lower imports from the Middle East and Australia.

S. Korea

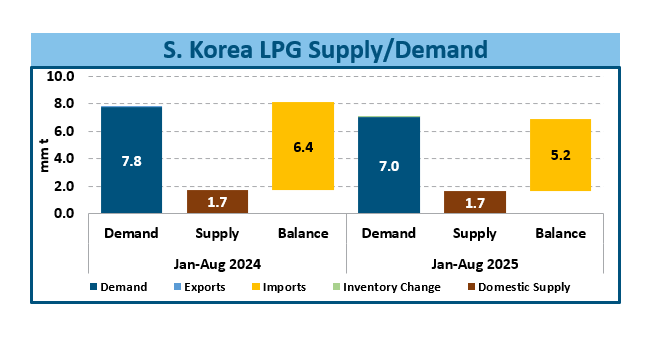

- Not only has S. Korea been a country likely to “swap” cargoes with Chinese importers for non-US volume, 2025 has seen many petrochemical players struggle with poor margins and operating levels for some plants have remained under pressure for most of the year.

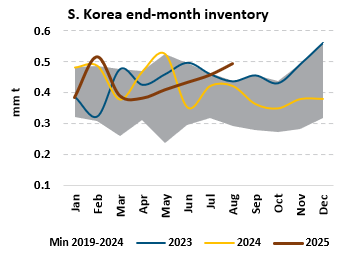

- Inventory levels over the last few months have been climbing and are currently above the high level seen from 2019-2024 for the time of year (see below chart).

- However, looking at the full supply/demand balance, inventory levels are less impactful than seen in Japan. For example, for the first 8 months of 2025, according to KNOC, demand has been lower than seen from January to August 2024. As a result, rather than inventory levels being altered drastically, imports have taken the hit.