Challenges ahead for China’s PDH sector as competition intensifies – Week 13 2025

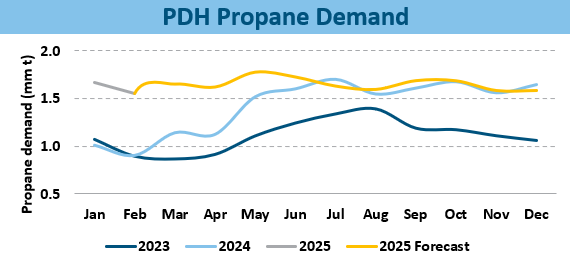

China’s propane dehydrogenation (PDH) sector saw a robust start to 2025, with propane demand for PDH operations in Jan-Feb 2025 maintaining levels comparable to those observed at the end of 2024. According to NGLStrategy, propane demand for PDH is expected to remain consistent throughout the year. However, there is potential for an increase in total volumes if ethylene production doesn’t meet current expectations, leading to reduced propylene output from steam crackers. This scenario could drive additional demand for propane as an alternative feedstock, further supporting the PDH sector’s growth in China.

Competition for PDH plants

- One of the most significant challenges facing PDH operations in 2025 is the growing competition from steam crackers. As additional capacity comes online—particularly from naphtha-fed plants—the supply of propylene to the market is set to increase.

- According to data from the National Bureau of Statistics (NBS), Jan/Feb 2025 saw strong ethylene production as new steam cracker capacity became operational in China. This surge in ethylene output has already constrained the growth potential for PDH plants, limiting their ability to expand operations. With further capacity additions expected later this year, PDH plants will face mounting pressure to serve as swing producers of propylene, adjusting output in response to market demand

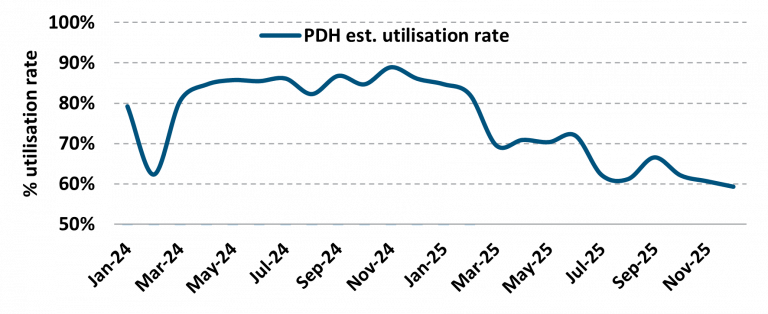

Chinese PDH Plants Utilization Rate

Operating rates to fall

- Although propane demand for PDH remains stable in China, overall plant utilization rates are projected to decline. This is primarily due to an increasing supply of propylene from alternative sources, coupled with the continued expansion of PDH capacity.

- In 2024, China saw the commissioning of seven new PDH plants, contributing an additional 4.8 mm t of propylene capacity. For 2025, NGLStrategy anticipates the startup of another four facilities, expected to add nearly 3.6 mm t of propylene capacity. However, potential delays in project timelines, particularly in the second half of the year, could affect the actual supply increase.

- It is important to note that actual utilization rates may be higher than projected, as some plants are likely to undergo maintenance or operate at reduced rates. As the market adjusts to these evolving dynamics, the PDH sector’s role in propylene supply will remain crucial, albeit under increasing competitive pressure.