Tariffs bring a whole new complexity to the market – Week 14 2025

Last week, President Trump announced tariffs for a range of countries importing certain products into the US including China.

In retaliation the Chinese government announced 34% tariffs on US products imported into China, including LPG.

Although current exemption policies will remain unchanged, the 34% tariff on top of the existing 1% will mean US propane and butane being imported into China will be 35% more expensive than current levels.

It is unclear the full extent of such announcements and the longevity of the tariffs, but NGLS discusses a range of scenarios to consider as a consequence, and the impact on the supply chain economics.

Scenarios to Consider

Return of Two-Tier Pricing

During the last Trump administration, a two-tier pricing system was observed:

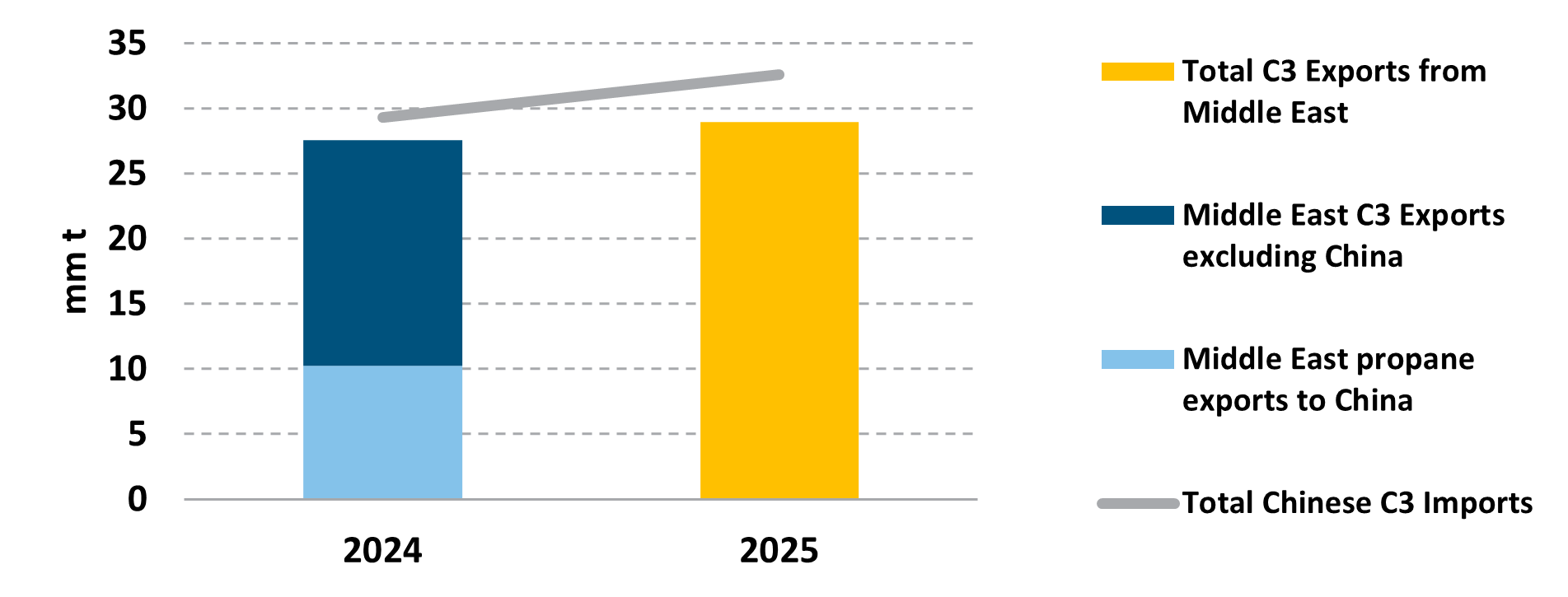

Middle East to China vs US to China. NGLStrategy estimates China to import a total of around 33 mm t of propane in 2025, with the Middle East estimate to export only 29 mm t, and not all will go to China as seen from the chart for 2024.

With insufficient LPG volumes exported from non-US origin to meet all Chinese demand, some volume will be subject to tariffs.

Propylene Demand Destruction

Higher feedstock costs could see destruction of demand for PDH operations with cancellations of new projects, as well as even lower operating rates/shutdowns, given the already current difficult economics.

Overall, this will lower propane consumption.

Global economic slowdown

Tariffs imposed by the US and associated retaliations have been reported to potentially lower overall economic growth and GDP rates.

This could directly influence the consumption of olefins/polyolefins such as ethylene/propylene lowering overall LPG consumption into petrochemical markets.

Change in Investment – Ethane vs LPG

A number of new petrochemical facilities are due to come onstream in China including ethane crackers.

Higher feedstock costs will question the viability of such projects having a knock-on effect on the start-up dates and potentially the diversion of assets into other industries i.e. VLECs into VLGC market

Lower US production

Ultimately if LPG is too expensive for petrochemical applications, prices in the US will have to decline challenging overall production economics and optimization of NGLs i.e. lower GPM levels.