Overview of the impact of 10% import tariffs for US to China volume – Week 20 2025

Revision Higher of Import Expectations but Challenges Remain

Further tariff announcements last week between the US and China provided some optimism in the LPG market. A 90-day reduction in tariffs was agreed reducing the import tariff for LPG from 125% to 10% for volume from the US to China. This was positive news for the propane market with the revision higher of Chinese demand for 2025 and a reduction of market complexity in terms of cargo swaps. But some level of tariffs remain, so what will be the impact of 10% for the already struggling petrochemical industry in China?

Overall demand expectations revised higher

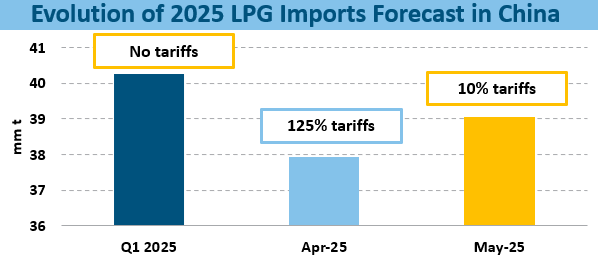

- Back in Q1 2025 before any tariffs were announced, NGLStrategy was expecting LPG imports in China to reach 40.3 mm t as we presented at the 30th China LPG International Conference in Guangzhou.

- When the 125% tariffs were announced, we revised our forecast reducing overall LPG import demand to around 38 mm t on the expectation of demand destruction.

- With the latest announcement of the reduction in tariffs to 10%, NGLStrategy has now revised its 2025 annual expectations for LPG imports to 39 mm t.

- A key sensitivity will remain the longevity of the lower tariffs, any further announcements and China’s inventory level management.

Steam Cracking Costs

Petrochemical economics continue to be difficult

- Although the reduction in import tariffs provides support to higher imports, NGLStrategy doesn’t expect levels to reach as high as initially expected at the start of the year.

- Part of the reasoning is that even through tariffs are reduced, with 10% on top of importing prices, economics for petrochemical plants are challenging for both steam cracking and PDH.

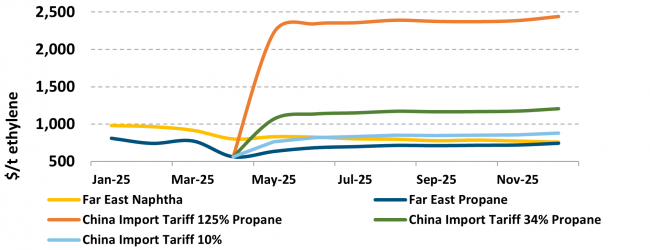

- As shown in the nearby chart, in the Far East for 2025, NGLStrategy currently expects propane to provide a lower production cost to ethylene than naphtha for the whole of 2025 with the spread narrowing towards the end of the year.

- If we add 10% import tariff on top of this, the cost for propane in China to make ethylene via steam cracking is more expensive than naphtha resulting in demand not expected to reach full potential.