The start-up of the 2,805 km long LPG pipeline in India from West Coast to the Northeast of India – Week 27 2025

New LPG Pipeline Commissioned

A new pipeline capable of transporting around 8.25 mm t of LPG has recently started commissioning in India and is expected to be fully operational later in 2025.

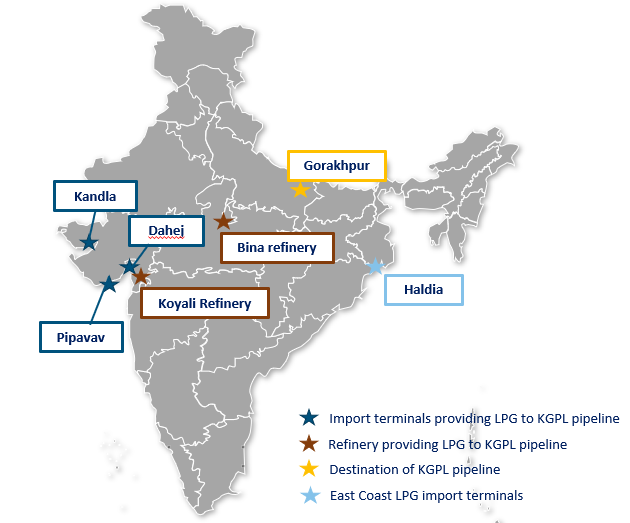

The 2,800 kilometer long pipeline will run from Kandla on the west coast of India to Gorakhpur in the north.

The pipeline is reported to directly link with 22 LPG bottling plants; 3 in Gujarat, 6 in Madhya Pradesh and 13 in Uttar Pradesh.

- According to IHB, the consortium responsible for the pipeline, LPG will be sourced from the import terminals Kandla, Dahej and Pipavav, along with two refineries at Koyali and Bina. The three companies leading the project are IndianOil (50%), HPCL (25%) and BPCL (50%), and have been developing the project since 2019.

- IOC have plans to increase capacity at their Kandla terminal by around 0.7 mm t which should help reduce congestion at the port. They are also in the process of increasing their refinery capacity at Koyali.

Impact on VLGC transports

- Indian LPG imports reached 20.6 mm t in 2024 according to PPAC, 72 % of this analyzed by ship tracking to have been on VLGCs (around 15 mm t)

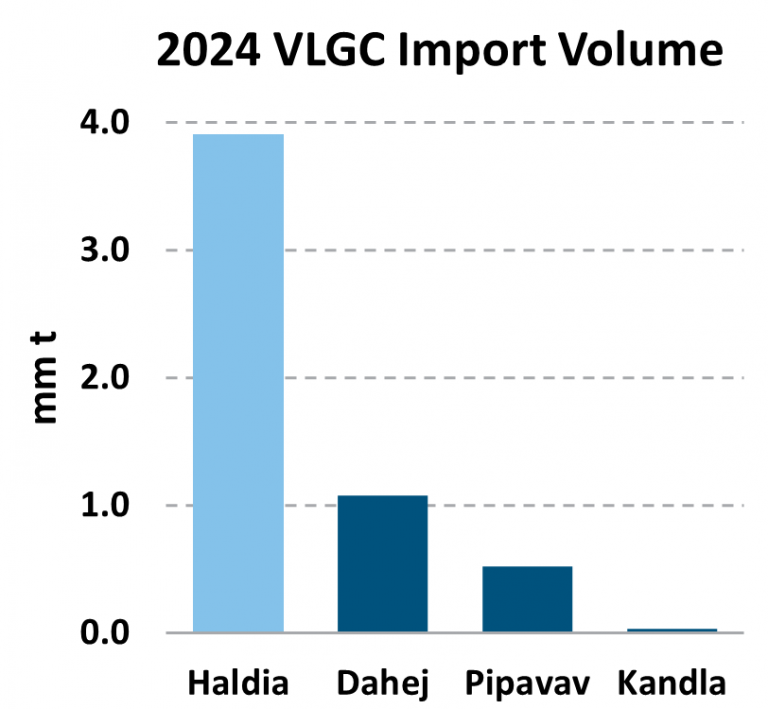

- The three terminals highlighted on the map providing the imported volume to the KGPL pipeline, collectively import around 1.6 mm t of LPG on VLGCs as seen by ship tracking analysis for 2024.

- Currently, as mentioned in a previous NGLStrategy weekly report (see Week 42 2024), the major port supplying the northeast of India is Haldia which received around 3.9 mm t of LPG on VLGCs in 2024. With the addition of the pipeline, we may see reduced imports into this terminal.

- However, a more likely possibility is the impact of the pipeline will be higher and more convenient distribution of LPG throughout India potentially increasing overall LPG demand.

Impact on Shipping

- A potential disruption of trade through the Strait of Hormuz could significantly impact global oil, gas, and LPG seaborne flows, prompting the need for replacement volumes from alternative sources. This would substantially increase ton-mile demand in the VLGC market, likely triggering sharp spikes in freight rates.

- Additionally, rerouting of cargoes away from the Suez Canal—toward the Panama Canal or the Cape of Good Hope—would further tighten vessel availability and support stronger shipping fundamentals.

- Concurrently, elevated crude oil prices would drive up bunker fuel costs, compounding the upward pressure on freight rates.

VLGC Deliveries to India: West Coast vs East Coast