Propane prices vs LNG in the East – Week 35 2024

Propane prices vs LNG suggest switching could be seen

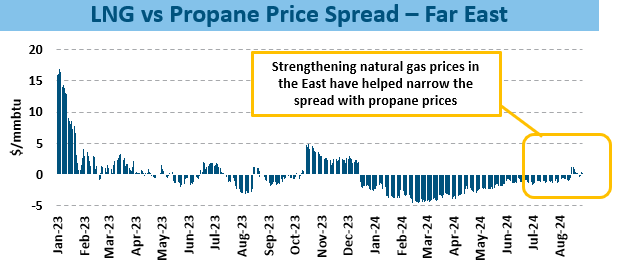

The price of LPG in the East vs LNG prices on a comparable mmbtu basis, has narrowed throughout the summer and as of late has shown an advantage over LNG. As a result, we could see some industries and countries switching from LNG to LPG to take advantage of some cost savings. It should be noted however, that the level of switching is limited due to infrastructure requirements and ease of transitioning.

- Looking at the graph nearby, you can see that for the majority of 2024, LNG has been favorable on a basic cost comparison basis, but that spread has narrowed through Q3 2024.

- At times where this has been the case in the past, we have seen some industries switch the consumption of natural gas out for LPG where available.

- One such sector is refineries who tend to keep their LPG produced within the plant as a fuel source, rather than sell it to third parties.

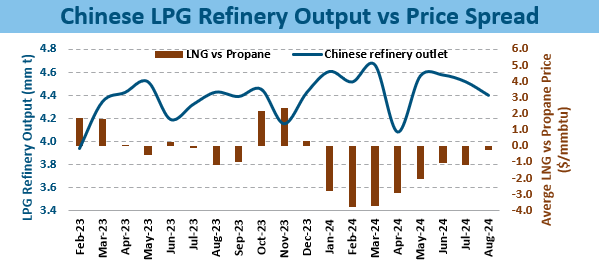

- In the other chart, we can look at the LPG output at Chinese refineries, according to NBS figures. Ignoring April 2024 where overall crude throughput was reduced, you can see that at times where the propane price is disadvantaged vs LNG prices e.g. Jan-Mar 2024, the output of LPG from refineries increased.

- More recently, with the narrowing of the spread between LNG and propane prices, the output of LPG from Chinese refineries has reduced.

- Another industry which could be seen to switch some natural gas consumption in favor of more LPG use is within the Indian ceramic industries.