US-China theoretical propane tariff price impact – Week 46 2024

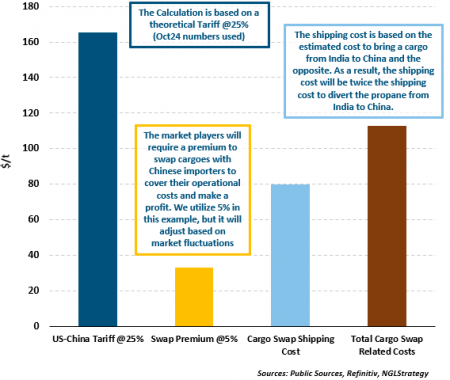

Key Calcs for Indian Propane Cargoes Redirected to China

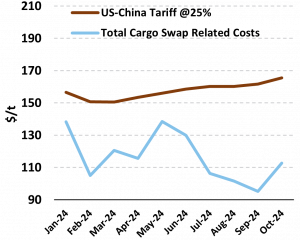

Estimation of the Price Impact on the Basis of 2024

The recent US elections have reignited concerns about a potential escalation in US-China relations, possibly leading to increased economic protectionism and tariffs.

While NGLS assumes tariffs on NGL markets are unlikely due to China’s limited alternatives, particularly for ethane but also for propane as detailed in our previous week’s feature, we assess the potential price impact should such tariffs be implemented.

- Using 2024 prices and shipping economics as a basis, NGLS developed a market assessment illustrated in the chart on the left. Key assumptions involve the “premium” market players and traders will assign to logistical and “convenience” costs for cargo swaps, as well as the expenses of diverting cargoes between India and China. India, as a major Asian importer, could provide sufficient re-directed propane volumes to complement Far East and S.E. Asia volumes that will be available to swap

- The feasibility of these cargo swaps will ultimately depend on the comparative economics of potential tariff costs versus the expenses incurred in executing the swaps and eventually the Chinese petchem economics.

- At a high level, based on the assumptions illustrated in the chart on the left, applying these estimations to 2024 figures, suggests a significant economic incentive to pursue such swaps. However, this would entail additional costs, and the logistics of an operation of this scale would be highly complex. These complexities would likely lead to cost escalations, including operational overheads and broader market impacts, such as increased freight rates driven by shipping constraints, further inflating total costs.

- Shipping would emerge as a major “winner” in this scenario. Beyond the direct impact of increased trades, the overall shipping supply/demand balance would tighten considerably. At a high level, for every 1 mm t of cargo rerouted from India to China, the market would require approximately two additional VLGCs. Also, market intermediates (i.e. traders, importers) would profit as well on the back of the cargo swaps “premiums”.