2025 in review: How actual market indicators stacked up against early forecasts – Week 49 2025

2025 was marked by significant volatility, driven largely by the impact of US–China tariffs, which remained the market’s key sensitivity throughout the year.

NGLStrategy’s early projections for 2025 did not anticipate the magnitude of these tariffs in the base-case scenario. As a result, the actual tariff levels materially reduced Chinese imports and placed sustained downward pressure on LPG prices in the East.

In this week’s update, we revisit several of our 2025 estimates for key indices, originally presented at our 2024 London seminar held in late November 2024.

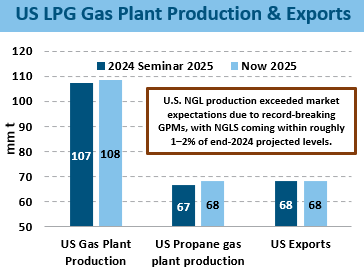

US

- Our initial expectation for US gas plant production in 2025 was just over 107 mm t. However, consistently strong NGL production economics and rising gas-to-oil ratios—particularly in the Permian—pushed actual LPG output above 108 mm t. Overall, NGLStrategy’s estimate was within 1% of the realized figure.

- Despite production exceeding the early forecast, US LPG exports to seaborne markets ended up broadly in line with expectations at 68 mm t. Tepid global demand, driven by geopolitical uncertainty, limited incremental pull for additional US cargoes. Consequently, US inventories rose to their highest recorded levels.

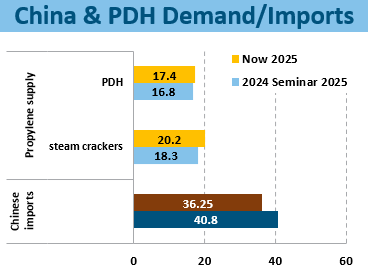

China & PDH

- A major divergence from initial expectations was in China’s imports. Rather than reaching the forecasted 41 mm t, imports came in significantly lower at just above 36 mm t. Retail consumption and steam cracker demand both softened due to weaker economics prolonged maintenance, displacement by alternative fuels, and uncertainty surrounding seaborne imports under the tariff environment.

- One area where NGLStrategy’s view remained closely aligned with actual outcomes was propylene supply from PDH plants. We initially projected output at 16.8 mm t; updated estimates now place this closer to 17.4 mm t – only a 3% differential. Overall propylene demand in China exceeded expectations, supported by incremental production not only from PDH units but also from steam crackers, which contributed an additional ~2 mm t above the original forecast.

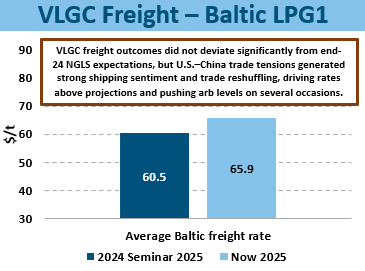

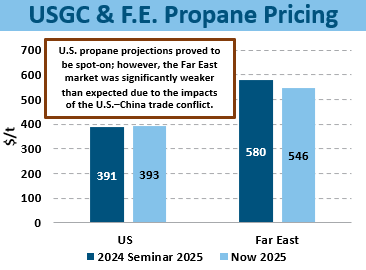

Pricing & Freight

- Propane price expectations for US Mt Belvieu were closely aligned with actuals, with only a 1% deviation. However, weaker Far East demand resulted in realized prices averaging roughly 6% below NGLStrategy’s late-2024 forecast.

- For freight, the 2025 Baltic rate was initially expected to average around $60.5/t. Increased cargo reshuffling and higher ton-miles—driven by a shift toward more US-to-South Asia and US-to-Southeast Asia flows due to tariffs—pushed rates higher. As a result, the average Baltic freight rate for 2025 is now expected to approach $66/t.