nglsadmin

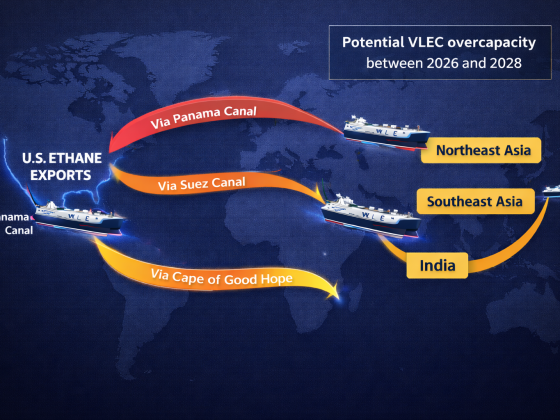

Modeling the VLEC market: Timing gaps between fleet growth and ethane demand – Week 07 2026

In recent years, newbuilding activity in the gas shipping sector has accelerated sharply, with substantial

nglsadmin

Global butane seaborne flows at a turning point – Week 06 2026

Seaborne butane markets have shifted rapidly in recent years, with US exports increasing strongly on

nglsadmin

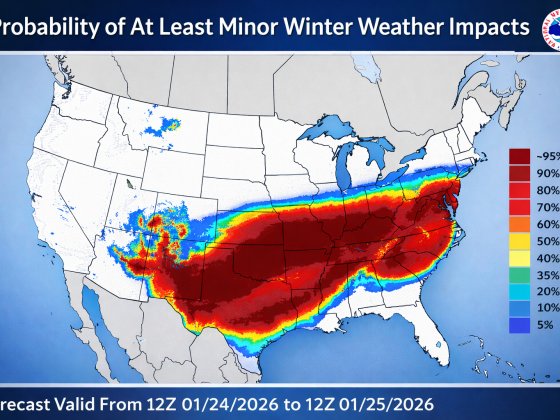

Cold front scenario analysis: U.S. propane supply and demand under a 3–5 day weather disruption – Week 04 2026

For yet another January, early weather forecasts failed to capture the emergence of a material

nglsadmin

2026 in review: expectations for higher supply requiring retail segments needing to absorb additional tons – Week 02 2026

2026 is expected to see significant growth in LPG gas plant production.

With demand within these

nglsadmin

US Petchems: operating rates rise strongly in Q3 – Week 50 2025

In Week 30 we highlighted the growth of US ethylene production in first half 2025.

nglsadmin

2025 in review: How actual market indicators stacked up against early forecasts – Week 49 2025

2025 was marked by significant volatility, driven largely by the impact of US–China tariffs, which

nglsadmin

Spotlight on US-China relations – Week 44 2025

Since the recent US presidential election, relations between the US and China have been at

nglsadmin

Chinese port fees: Bracing for the impact of escalating US/China trade tensions – Week 41 2025

On 14 October, China’s special port service fee takes effect on U.S.-related vessels (built, flagged,

nglsadmin

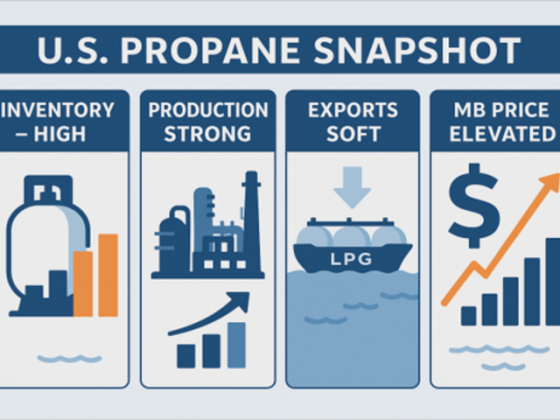

Mont Belvieu at a crossroads: price correction or persistent elevation? – Week 40 2025

2025 has been an atypical year for global energy markets, including LPG, with geopolitics increasingly

nglsadmin

USTR Fees: Implications for the VLGC Market – Week 37 2025

On 14 October, USTR Section 301 port-entry fees take effect on Chinese-owned/operated and Chinese-built vessels.